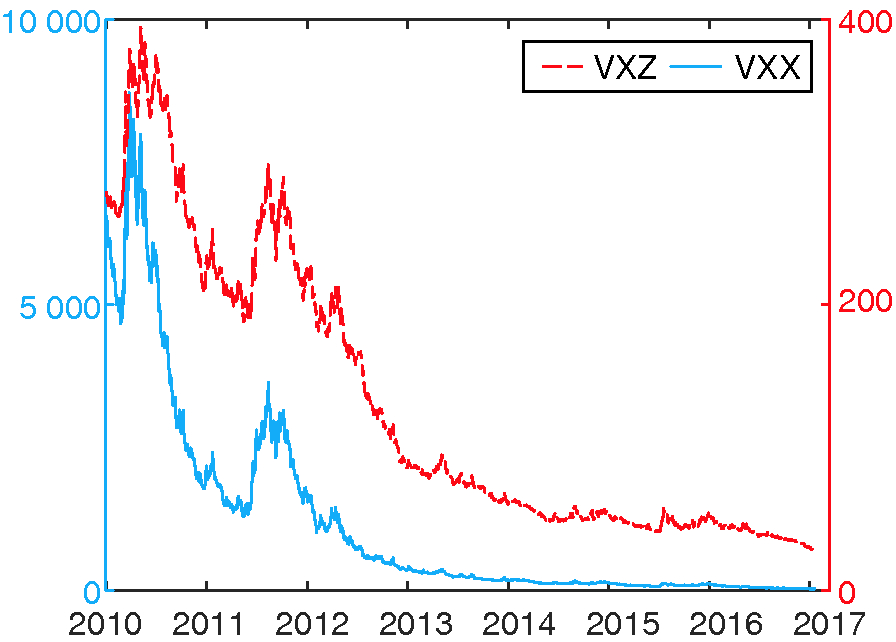

Statistics of VIX futures and their applications to trading volatility exchange-traded products - Journal of Investment Strategies

iPath® Series B S&P 500® VIX Short-Term Futures ETN Fund Forecast: down to $0.164? - VXX Fund Price Prediction, Long-Term & Short-Term Prognosis with Smart Technical Analysis

Pricing VXX options by modeling VIX directly - Lin - 2022 - Journal of Futures Markets - Wiley Online Library

Here Is Why You Shouldn't Forecast The VIX For A VXX Trading Strategy — A Backtest On Volatility Forecasting Models | by Michael Dampf | Medium